cash settled warrants

The holder of a cash-settled warrant almost all derivative warrants currently listed in Hong Kong are cash-settled will receive a cash payment of an amount equal to the positive difference between the exercise price of the put warrant and the settlement price of the underlying assets adjusted by the entitlement ratio. Commodity warrant can be settled either through cash settlement or physical delivery.

Drafting Considerations For Attorneys Blog Series Debt Issued With Warrants And Convertible Debt Marcum Llp Accountants And Advisors

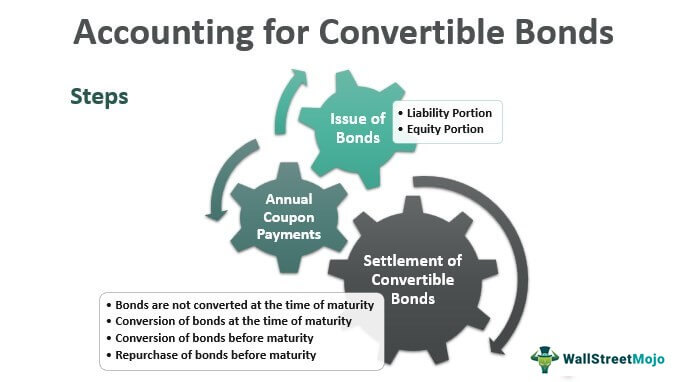

An issuer can carry them at cost or at the fair value.

. Cash Settlement Price 20500 20200 900 x 050 MYR 01667 per warrant If you are holding 100000 units of HSI-C14 after the warrants last trading day on 25th March Friday you will receive MYR 16670 which is calculated as per below. Cash settled warrants Practical Law UK Legal Update 4-101-5739 Approx. These are warrants that are not accompanied by a bond and are traded on the stock exchange like ordinary warrants.

Generally a warrant would not create any obligation to deliver cash instead it would be settled by the issuer company by issuing additional shares of the Company. Glossary Cash settlement warrants Form of settlement in which the issuer of the warrant pays a cash sum to the warrant holder instead of delivering the underlying instrument. The General Directorate of Taxes recently issued anon-binding ruling that clarified the tax treatment for Spanishresidents with income derived from cash settled warrants.

Method of Exercise of Warrants. Warrantholders will not be required to deliver an exercise notice. Additional filters are available in search.

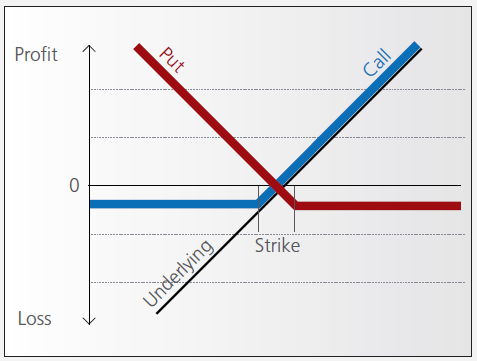

If the underlying instrument cannot be physically delivered to the warrant holder eg in the case of index warrants the contract is settled in cash. Cash-settled futures require the transfer of an amount of cash determined by the difference between the original fixed price of the contract and the floating final settlement price determined by the published reference price from the PRA. Such warrants are issued by the producers of commodities or by financial intermediaries.

Cash settlement is a settlement option frequently used in trading of futures and options contracts where at the expiration date the underlying assets are not physically delivered while only the difference is being paid by either of the parties depending on the market rate at that point of time. Thus any change in the value of a derivative reflects the price fluctuation of its underlying asset. Cash settlement involves the purchaser or the contract holder to pay the net cash amount on the settlement date and execute the commodity settlement.

In some warrant agreements the inputs used to calculate the net settlement amount ie shares to be delivered may be different depending on if the warrant is held by the foundersponsor or if it is held by a third party. Some warrants permit net share settlement upon exercise frequently referred to as a cashless exercise. School Kaplan Business School.

Cash settlement warrants Form of settlement in which the issuer of the warrant pays a cash sum to the warrant holder instead of delivering the underlying instrument. Cash settlement can be defined as a method or an arrangement in which the seller of a contract prefers to settle the transaction in cash instead of delivering an underlying asset Underlying Asset Underlying assets are the actual financial assets on which the financial derivatives rely. Disposition of Warrant and Exercise Shares.

Cash Settlement Price 20500 20200 900 x 050 MYR 01667 per warrant If you are holding 100000 units of HSI-C14 after the warrants last trading day on 25th March Friday you will receive MYR 16670 which is calculated as per below. The Warrants are cash-settled warrants which entitle a Warrantholder to be paid a cash settlement amount if positive the Cash Settlement Amount in accordance with the terms and conditions of the Warrants. Pages 46 This preview shows page 11 -.

With cash-settled futures there is no transfer of LME warrants or physical metal. The net cash amount is the difference between the spot price SP and the futures price FP of the underlying s. If the underlying instrument cannot be physically delivered to the warrant holder eg in the case of index warrants the contract is settled in cash.

Our cash-settled contracts are tradable out to 15 months on LMEselect or the inter-office market. You are investing in cash settled put Information warrants that may allow you to benefit from decrease in the price level of the Underlying Shares which are the ordinary shares of Geely Automobile Holdings Limited. 100000 units of HSI-C14 x MYR 01667 per warrant MYR 16670.

A cash settlement is a settlement method used in certain futures and options contracts where upon expiration or exercise the seller of. Cash settled warrants are settled by a cash payment. If the Cash Settlement Amount less any Exercise Expenses is positive all Warrants will be.

Shares or cash Warrants that depending on their status at expiration can be settled in either cash or physical delivery of the shares. In such case warrants would be classified as equity and not a financial liability Classification of financial instruments into financial liability and equity. Information relating to the Underlying Shares may be obtained from the Companys website.

Cash Settled Warrants Sample Clauses. If the issuer issued warrants instead of a bond the issuer would also recognize the value of the warrants as 1000 to the warrant liability account in the liabilities section of the balance sheet. The difference between the.

Incomesubject to the ruling qualified as a capital gain and. Warrant Price Duration and Exercise of Warrants. A warrant that gives the holder the right to receive a fixed quantity of a certain commodity such as wheat rice gold silver oil etc at a fixed price.

Course Title FIN MISC. When the final settlement price is higher than the. The Warrant Cash banding report shows the number of market participants with a concentration of LME warrants Tom Cash and Cash plus one day positions expressed as a percentage of live stock.

The number of market participants are displayed by metal and across five bands. The more conservative approach is to classify the warrants as equity. The settlement price of a put warrant is the 5-day average.

Examples of Cash Settled Warrants in a sentence Furthermore holders of such Warrants incur the risk that there may be differences between the trading price of such Warrants and the Cash Settlement Amount in the case of Cash Settled Warrants or the Physical Settlement Value in the case of Physical Delivery Warrants of such Warrants. For example Apple initially classified its 250 million. 2 pages Ask a question Cash settled warrants.

100000 units of HSI-C14 x MYR 01667 per warrant MYR 16670. It is the more convenient and preferred method of.

Calculating Structure Warrant Cash Value Youtube

Derivatives Speculative Transactions Tax Aspects Bombay Chartered Accountants

Spac Warrants And 8 Frequently Asked Questions

Financial Reporting Alert 20 6 Accounting And Sec Reporting Considerations For Spac Transactions October 2 2020 Last Updated April 11 2022 Dart Deloitte Accounting Research Tool

815 40 55 Implementation Guidance And Illustrations

Warrant Quick Guide Ambank Group Malaysia

5 6 Analysis Of A Freestanding Equity Linked Instrument After Adoption Of Asu 2020 06

Total Return Swap Definition Cash Settled Equity Swap Explained

Ias 33 Eps Impact Of Share Based Payments Annual Reporting

Total Return Swap Definition Cash Settled Equity Swap Explained

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Derivative_Aug_2020-01-8b165b177a3a4a06951b2c33dede9f8a.jpg)

Comments

Post a Comment